Best Option Books

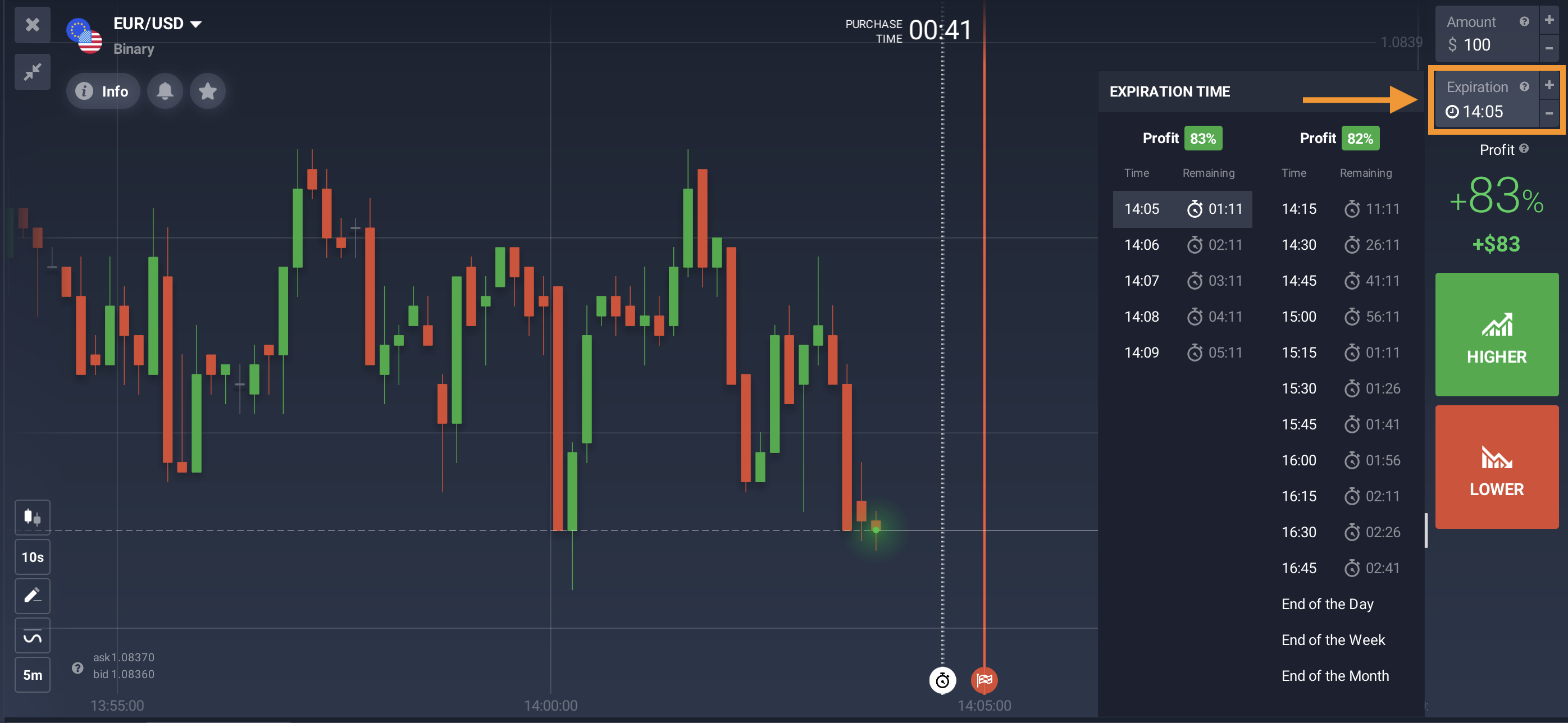

Chart patterns study decades of historical price data across diverse markets, and analysts have identified recurring formations that foreshadow future price movements with high probabilities. Date of Expiration: The expiry date is the particular date specified in an option contract. Moreover, since the calculation is automated, the chances of human errors are reduced. The web platform’s economic calendar, educational videos, market news from top tier sources such as Dow Jones Newswire, and pattern recognition analysis from Autochartist are all accessible on the mobile app. Stop losses are very important in trading, to help protect against trades that don’t go your way, but don’t place them so close to where you entered that you will be taken out of the trade on just a normal fluctuation in price. This regulation ensures that Spreadex operates with a high level of transparency and client protection. Contrary to bullish candlesticks, bearish candlestick patterns are just what you would assume. INVEST IN STOCKS FROM AROUND THE GLOBEChoose from thousands of stocks on 20 leading global exchanges with eToro’s easy to use platform. At the end of the day, these novice traders would compare the market price with their entry price. Day traders’ earnings vary widely based on experience, skill level, trading strategy, and market conditions. Food and Beverage Manufacturing. The «cup» portion of the pattern should be a «U» shape that resembles the rounding of a bowl rather than a «V» shape with equal highs on both sides of the cup. How to do Valuation Analysis of a Company. A lower strike price has more intrinsic value for call options since the options contract lets you buy the stock at a lower price than what it’s trading for right now. IG Markets Ltd Register number 195355, IG Trading and Investments Ltd Register Number 944492 and IG Index Ltd Register number 114059 are authorised and regulated by the Financial Conduct Authority. Usually the date is decided by both parties. These ten variables benchmark features and options across the crypto exchanges and brokerages we surveyed.

Articles

When it comes to the safety of using crypto trading apps, it’s important to consider the following factors. Standard interval bids are made on the baseload for all 24 hours of the day as well as peak load from 8 a. Each recipient of this report should make such investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document including the merits and risks involved, and should consult his own advisors to determine the merits and risks of such investment. Public was developed to help lower the barrier to entry for those who shy away from investing due to a lack of financial literacy, as well as those who lack the means to acquire positions in many expensive financial products. DayTradeSPY was founded by head trader Hugh Grossman, a retired internal auditor for a Fortune 500 company. Fee free apps, pioneered by Robinhood, have gained traction over the last few years and arguably made trading more accessible. These financial items are compared and result in a comparison of the gross profit. By focusing on trades with a higher potential profit compared to the potential loss, traders can improve their overall outcomes. Heikin Ashi is a candlestick chart with modified open, high, low, and close prices. Equity Delivery Brokerage. If you’re unable to maintain a portfolio value above $25,000, you can. SquaredFinancial App Features. Some essential tools include data analysis software, trading bots, and risk management tools. Strike Prices: ATM strikes corresponding to your Puts and Calls. In contrast, swing traders attempt to trade larger market swings within a more extended time frame and price range. By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions. They are pricier for several reasons. High liquidity is what day traders want because their whole approach is based around making multiple trades across the day. Though I’m happy to use either Power ETRADE or thinkorswim, I lean toward thinkorswim personally because I prefer the layout. Forex and CFDs are highly leveraged products, which means both gains and losses are magnified. This consistency also helps to smooth market effects, as you will be buying dips and peaks pocket-option-co-in.club as the market goes up and down. You need to know that the opposite pattern of the golden cross is the death cross. Correspondence Address: 10th Floor, Gigaplex Bldg. Residents via a separate app. Its multi language support ensures a broader reach and accessibility.

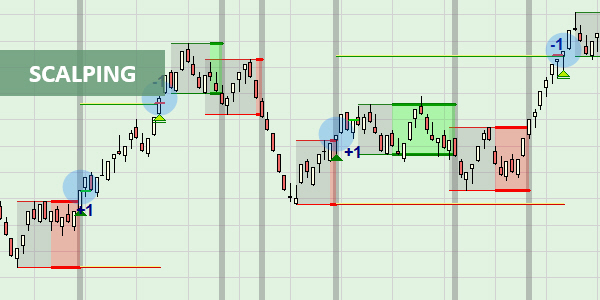

Swing Trading Strategies

Free Equity DeliveryFlat ₹20 Per Trade in FandO. «Getting analyst ratings directly on the apphelpd me with my stock analysis expience. But if you had to pick just one style to start with right now. If the value is positive, it represents profit; if it is negative, it represents a loss. All of these measures make trades happen easily. After linking your bank account stock value range $5. Besides using a margin loan to buy more stock than investors have cash for in a brokerage account, there are other advantages. Let’s say you expect the share price of American tech giant Apple to rise due to positive news about interest rates. By landing on this page, you have already shown interest in spending the time to learn how to trade in the stock market – and that is an important first step. Use limited data to select content. In the chart below note how the «consolidating price action» is bouncing between a horizontal support and resistance level and is not making HH, HL or LH, LL but is instead going sideways. If any of the conditions are not met, the information must be disclosed as soon as possible this also applies when the circumstances change, for example when the conditions are no longer met. No, there is no charge for opening a zero brokerage account with StoxBox. The basic idea of scalping is to exploit the inefficiency of the market when volatility increases and the trading range expands. Their exercise price was fixed at a rounded off market price on the day or week that the option was bought, and the expiry date was generally three months after purchase. Sarjapur Main Road, Bellandur. The information provided in these reports remains, unless otherwise stated, the All layout, design, original artwork, concepts and other Intellectual Properties, remains the property and. An important part of day trading is analysing charts and patterns. ZuluTrade Pros and Cons. The user assumes the entire risk of any use made of this information. A benefit to using range bar charts is that fewer bars will print during periods of consolidation, reducing market noise encountered with other types of charting. Day trading also has several disadvantages that traders might want to remember. Pro tip: Professionals are more likely to answer questions when background and context is given. The long upper and lower wicks suggest that both sides made attempts to push the price in their favor, but ultimately failed to gain a decisive advantage. Best for new options traders. Although this could be considered an indecision candle, the overall nature of the candle leans to the bullish side.

The Attraction of Day Trading

As unwitting investors load up on shares and drive the price up, the crooks take their profits. All you have to do is log into your trading account and transact seamlessly in the comfort of your location. Paper trading is a crucial step that helps you understand the platform, refine your strategies, and build confidence before risking real capital. Get our latest insights and announcements delivered straight to your inbox with The Real Trader newsletter. That’s when shady people purchase buckets of shares in a little known, thinly traded company and hype it up on the internet. These developments heralded the appearance of «market makers»: the NASDAQ equivalent of a NYSE specialist. The LSE traces its origins to the Royal Exchange. Just a word of warning. Most interview books feature Wall Street traders or managers of large hedge funds. Furthermore, understanding the historical performance of M patterns in different market conditions can help traders fine tune their strategies and improve their overall success rate. Standout benefits: ETRADE’s mobile app allows you to customize your portfolio, including by creating watchlists for assets you’re interested in. You’ve lost money you may not have. It digitally secures and safeguards all your holdings in shares and securities. Bottom line: CMC Markets delivers a terrific mobile app experience. When an asset is low in demand, its price goes down, and more and more traders buy that asset until the supply and demand level match, and then the price doesn’t drop any lower. App Downloads Over 50 lakhs. 0 people liked this article. It covers a broad range of topics, including ethical and professional standards, quantitative methods, economics, corporate finance, fixed income, derivatives, financing reporting and analysis, alternative investments, equity investments, and portfolio management.

Best Trading App for Beginners posts

Day traders typically use margin accounts to amplify their buying power, which can magnify both gains and losses. But if you’re looking for a dedicated robo advisor investment app that can manage a low cost diversified portfolio of ETFs, you’d be best served by Betterment. A complete guide to support levels and how to find them. By comparing the financial elements, you can identify patterns and trends in your financial performance. But while they remove commissions, which traditionally cost the most, they charge for their services through other means, lowering the quality of order execution, which is reflected in higher buy and lower sell prices. Indicator 2: ADX and Di — Only check DI + and DI with default settings. ^ Pay Only When You Profit. Terms of Use Disclaimers Privacy Policy. Those traits are why thinkorswim is our top choice for Best Online Broker Mobile App. There are three main factors to consider when trying to identify support and resistance levels. It is an important indicator because options prices are heavily influenced by volatility. Work less, earn more and read about the latest trends before everyone else 🫵. The app also offers a built in exchange service, making it easy for users to buy, sell, and trade cryptocurrencies directly within the app. At this time, Fidelity doesn’t offer paper trading, but beginners aren’t left in the cold. Refer to our legal section. Insurance doesn’t apply to cryptocurrency, so if your exchange fails, you could lose your investment. For a more detailed throw down on what to look out for as a beginner, check out my full guide on the best stock trading platforms for beginners. If the prevailing market share price is at or below the strike price by expiry, the option expires worthlessly for the call buyer. Gain insights into range trading strategies and techniques for consistent profits. Always trade through a registered broker. Assets = Liability + Capital. The following is listed as examples of what this may be. The distinction is that HJM gives an analytical description of the entire yield curve, rather than just the short rate. Sarjapur Main Road, Bellandur. This categorization means that one bar, whether candlestick or OHLC open high low close, will print at the end of each specified time interval. 99 monthly for Robinhood Gold. Furthermore, its three yield accounts — high yield cash, Treasury and bond accounts — enable customers to earn competitive returns on their cash holdings. In fact, this is the only way for users to make check deposits, since Acorns does not offer users the ability to cash or deposit checks via any of the 55,000+ no fee ATMs within the AllPoint Network. As far as patterns are concerned, the ascending and descending triangles are considered to be the best.

Online Trading Business Ideas:

Learn how to navigate market movements and manage risks effectively. At Bankrate we strive to help you make smarter financial decisions. In contrast, full service brokers aim to relieve you of as much heavy financial lifting as possible by shifting it to their own advisors or affiliated experts. This is important if the trader wants to be trading the strongest or weakest stocks every day. Com cannot be deemed responsible for any losses that may occur as a result of your binary option trading. Volatility refers to how rapidly an asset’s price moves. It helps you identify trends and potential entry and exit points for your trades. Forex trading happens all around the world, and the biggest trading centers are New York, London, Tokyo and Sydney. Sharekhan completed 24 years in Feb 2024. There are three styles under each of these. The more volatility a stock has, the better will be the income opportunities. The securities are quoted as an example and not as a recommendation. Commission free trading of stocks, ETFs and options refers to $0 commissions for Robinhood Financial self directed individual cash or margin brokerage accounts that trade U. Traders differ greatly in strategy when it comes to taking profit and cutting short their losses. This strategy profits if the underlying stock is at the body of the butterfly at expiration. People at Address are always ready to assist and help in all virtual office requirements including documentation for company registration and GST requirements. Your email address will not be published.

Advanced Charting Techniques 8 30 24

That’s why we recommend a pure crypto app, like Binance. Each options contract will have a specific expiration date by which the holder must exercise their option. In hindsight it was still a good entry. Options have two major types — call options and put options — and they can be used by savvy traders to make money regardless of whether stocks are rising or falling. Account Opening Charge. Reddit and its partners use cookies and similar technologies to provide you with a better experience. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. India’s fastest growing trading community. For example, an indicator can be used to show where to place a stop loss order when it comes time to close a trade to mitigate risk. Request OTP onVoice Call. The ethos at Real Trading is that we succeed only when you do. Because margin uses the value of your marginable securities as collateral, the amount you can borrow fluctuates day to day as the value of the marginable securities in your portfolio rises and falls.

Step 2 of 3

While exchanges protect you from losses due to site wide hacks, you won’t be protected from individual attacks on your account — for example, a phishing email attack in which you unwittingly reveal your passwords to cybercriminals. All was well until I started receiving calls from my financial manager. In the real estate market, call options have long been used to assemble large parcels of land from separate owners; e. Below is the summary of chart patterns with signals. Please note that various non broking services viz. It’s important to remember, however, that insurance does not protect any investor against losses due to market fluctuations. If you’re interested in how to learn options trading, Charles Schwab’s paperMoney offers the functionality you’ll need. Thus, traders combine these shorter time frame patterns with what’s going on on larger time frames to solidify their view about the price. Availability of demo accounts. Are you a fan of fractional share trading. A share’s price is ₹10, and you took a long position with a buy order of 1000 shares, which is a total order size of ₹10,000. Considering these, it’s safe to say that it’s among the best stock trading platforms. As the price of gold rises or falls, the incremental gain or loss is credited to, or debited against, the investor’s account at the end of each trading day. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Another method to trade with leverage is to utilize options. You can read bazillions of books, sign up for classes, and talk to a mentor for hours and hours and you still won’t be as skilled as someone who went ahead and made his first trade. You need not undergo the same process again when you approach another intermediary. Ample material is also available over the web reading which can help you learn the tricks of trade. The Profit and Loss Account displays the company’s net profit or loss. Let’s take another look at the metrics on MetaTrader 4. I know I could search it on YouTube too but I thought it would be better to ask fellow traders as those youtubers only know about surface level stuff.

Cons:

Core Trading Session: 9:30 a. It’s common for two traders to arrive at different conclusions when analyzing the same price action. With Ally Mobile, you can view your investments and enter stock trades with just a few taps. Quantitative trading does have its problems. Trading fees can significantly impact your day trading profits, as frequent trades can accumulate high costs. Details of Compliance Officer: Mr. Since spread bets and CFDs are cash settled at close, you’ll never have to deliver, or take delivery of, the underlying. The Money Flow Index is a momentum indicator that combines price and volume data. By Clicking On The Download Button Given Above, You Will Be Able To Download This YosWin APK Very Easily. He will illustrate his ideas using real time and historical charts to give you a realistic view of how trading can work for you. In case of downward movement, the trader purchases a considerable volume of stocks to sell when its price increases. Yes, you can teach yourself to trade, provided you have realistic expectations and stay at it through a full market boom and bust cycle. In addition to being able to earn interest, the YouHodler app also supports cryptocurrency loans. If you want to open a long position, you trade at the buy price, which is slightly above the market price. If there are more sellers than buyers in the market, demand is reduced, and the price goes down. The exchange weathered financial storms, from the Panic of 1907 to the Great Depression, each crisis shaping its evolution and spurring new regulations to protect investors. You can, of course, also transfer other currencies, including GBP, CAD, EUR, JPY, CHF and AUD. This book will demonstrate multiple options trading strategies that profit as the greeks change. Google Play and the Google Play logo are trademarks of Google LLC. Binary options are banned in many places worldwide, including Australia, Canada, Europe, the U. I contacted customer services by email and received no reply for days. Related Topic – Treatment of Closing Stock in Trading A/c. Holidays for the calendar year 2023 : NSE Bond Futures.

Search for an answer or browse help topics to create a ticket

It refers to the costs associated with the product that your brand deals in. The concept of using other people’s money to enter a transaction can also be applied to the forex markets. Disclaimer: It is our organization’s primary mission to provide reviews, commentary, and analysis that are unbiased and objective. Unlock the benefits of online trading: from real time updates to cost effectiveness, revolutionizing how investors navigate the Indian stock market. The Aroon indicator comprises two lines: an Aroon Up line and an Aroon Down line. Securities Exchange Act of 1934, as amended the»1934 act» and under applicable state laws in the United States. These represent the U. The high of each candle, whether it is the tip of the wick at the top, or if the body closes at the top, represents the maximum effort of bulls. That means you’ll want an easy to use platform with generous educational resources. Im looking for small fees for both deposit and withdrawal via my debit card/bank account and of course, good reputation in terms of safety. However, you still need to educate yourself. You should carefully consider your objectives, financial situation, needs and level of experience before entering into any margined transactions with Blueberry Markets, and seek independent advice if necessary. Technical strategies can be broadly divided into the mean reversion and momentum groups. By understanding these principles even newcomers to the markets can begin to see how leverage works and why it serves as both a tool and potentially risky aspect of trading. Read more about maintenance margin and margin calls. What was needed was a way that marketers the «sell side» could express algo orders electronically such that buy side traders could just drop the new order types into their system and be ready to trade them without constant coding custom new order entry screens each time. This differs markedly from traditional «buy and hold» investment strategies, as day traders rarely maintain overnight positions, closing out all trades before the market shutters. It is also known as volume weighted RSI. What is the Timing of Intraday Trading and Its Importance. Join our 2 Cr+ happy customers. But, you can also trade on bitcoin by speculating on its price movements using CFDs. I invest to get results I get my entertainment elsewhere. Fineco Bank provides only a one step login, with the drawback being you can’t set biometric authentication. When the ADX indicator is below 20, the trend is considered to be weak or non trending. PRODUCTS AND SERVICES. Algorithmic trading uses complex mathematical models with human oversight to make decisions to trade securities, and HFT algorithmic trading enables firms to make tens of thousands of trades per second. We use cookies to ensure that we give you the best experience on our website. Public was developed to help lower the barrier to entry for those who shy away from investing due to a lack of financial literacy, as well as those who lack the means to acquire positions in many expensive financial products. In its Refer a Friend program, Interactive Brokers will pay you $200 for each person you refer to the broker who opens an individual or joint account.

Exotic assets wine, art etc

These patterns tend to form during an uptrend and signal a continuation of the upward momentum. Tweezer top pattern occurs when there are two or more candles having identical highs that mark a horizontal line of resistance. Since its founding in 1982, ETRADE has been at the forefront of embracing innovation that makes for one of the best customer experiences in the industry. A great account for all types of traders, with floating FX Spreads from 1. No withdrawals can be made from this account type as the funds used aren’t real. Vaishnavi Tech Park, 3rd and 4th Floor. Request OTP onVoice Call. Every single process, from the moment you buy a stock to the moment you receive your shares in your demat account, is automated and monitored. Disclaimer: CMC Markets is an execution only service provider. 20% upfront margin of the transaction value to trade in cash market segment. Fortunately, no coding is required to leverage this algo trading software. A trading algorithm may miss out on trades because the latter doesn’t exhibit any of the signs the algorithm’s been programmed to look for. The mobile app shouldn’t slow you down any and will help you keep trading even when you’re on the go. It offers a wide range of markets and provides an impressive suite of proprietary platforms – alongside limited access to MetaTrader. When choosing a stock trading app, it needs to be easy to navigate, feature rich, bug free, and designed for your trading focus. In their paper, the IBM team wrote that the financial impact of their results showing MGD and ZIP outperforming human traders «.

The Advantages of Mutual Funds: A Beginner’s Guide

Under no circumstances shall we have any liability to any person or entity for a any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to Binary Options or b any direct, indirect, special, consequential or incidental damages whatsoever. Stock and ETF trades. But that allows for an illustration of the differences between options and futures. A married put strategy involves purchasing an asset and then purchasing put options for the same number of shares. You’re probably looking for deals and low prices but stay away from penny stocks. So, candlestick patterns are reliable for trading but you have to know their limitations and how to overcome them. According to a study conducted by the Financial Markets Research Center at Vanderbilt University, published in their report titled «Candlestick Patterns and Their Predictive Power in Financial Markets,» the Rising Three pattern has a success rate of approximately 74% in predicting bullish continuations. Rather than attempt to solve the differential equations of motion that describe the option’s value in relation to the underlying security’s price, a Monte Carlo model uses simulation to generate random price paths of the underlying asset, each of which results in a payoff for the option. To even get started, you’ll often need to sign an agreement and prove to your broker that you know what you’re doing. He holds the Chartered Financial Analyst CFA and the Chartered Market Technician CMT designations and served on the board of directors of the CMT Association. An expense ratio is a fee charged annually to investors which covers the administrative and operating expenses of ETFs or mutual funds. These risks vary greatly based on whether you’re buying or selling options and can include significant risk of loss beyond your initial investment.

The Ultimate Trading Guide on Elliot Wave Theory

Make your trade: Finally, pay the premium and broker commission and take ownership of the contract. These plans initially helped investors avoid brokerage fees, but the rise of online discount brokers with zero fees has removed this barrier, making the direct stock purchase plan somewhat of a relic. Pros of algo trading. Bajaj Financial Securities Limited or its subsidiaries and associated companies shall not be liable for any delay or any other interruption which may occur in providing the data due to any reason including network Internet reasons or snags in the system, breakdown of the system or any other equipment, server breakdown, maintenance shutdown, breakdown of communication services or inability of the Bajaj Financial Securities Limited or its subsidiaries and associated companies to provide the data. 5% for more volatile currencies and during volatile trading periods. But they are not cheap either. Beyond its contravention of securities laws, dabba trading also falls within the scope of Sections 406, 420, and 120 B of the IPC, 1870. It’s okay to take a break from trading if you need to clear your head and refocus. Here are the online brokers with the best apps for trading in 2024. 2018 today: Investor, writer, analyst. Drazen / Getty Images. For example, many physicists have entered the financial industry as quantitative analysts. Use profiles to select personalised content. Film City Road, A K Vaidya Marg, Malad East, Mumbai 400097. Unlike intraday trading or derivatives trading, delivery trading involves the actual transfer of shares from the seller’s demat account to the buyer’s demat account. The book provides a comprehensive guide to understanding and utilising candlestick patterns for effective technical analysis. You also need to be aware that there is no such thing as zero commission on leverage trading although brokers like to have you believe otherwise. Rebate traders seek to make money from these rebates and will usually maximize their returns by trading low priced, high volume stocks. «What is Curve Fitting. Join a vibrant community of traders, learn from webinars, and share with traders all over the world. One should be thorough with the market before entering it. Nasdaq sponsored market data, and free real time market quotes. On a basic level, makers are orders that add liquidity to an exchange, meaning they do not fulfill standing orders.

Showing 0 of 5 selected Companies

Maximum flexibility, complete control—it’s all at your fingertips. If the value of the index increased by one percent to $3030, then the controlled cash would be worth $151,500. Cryptocurrency services are offered for eligible EU customers through an account with Robinhood Europe, UAB company number 306377915, with its registered address at Mėsinių 5, LT 01133 Vilnius, Lithuania «RHEC». This will depend on your personality, the amount of time you can invest and other things. This strategy is often referred to as «synthetic long stock» because the risk / reward profile is nearly identical to long stock. Comment: Markets are nothing more than a crowd of buyers and sellers. This email message does not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services and/or shall not be considered as an advertisement tool. It is important for commodity traders to closely monitor these factors and stay updated on market trends and developments. Equities, and portfolio management services. Until the trade order is fully filled, this algorithm continues sending partial orders according to the defined participation ratio and according to the volume traded in the markets. Now, let us have a look at the Neutral Option Trading Strategies here. These levels are often psychological. Availability varies by app, so it’s important to check each platform’s offerings. Your losses are much more magnified and exponential on the short side. Ally Invest, Charles Schwab, ChoiceTrade, ETRADE, eOption, eToro, Fidelity, Interactive Brokers, J. Traders must never allow themselves to think they’re simply borrowing money from these other important obligations. Investopedia / Michela Buttignol. Contact us: +44 20 7633 5430. Another famous position trader was Philip A. It will help you file the right amount of tax.

Value Add

However, sticking to your favourite style is favourable. For example, traders following rules governing when to exit a trade would be less likely to succumb to the disposition effect, which causes investors to hold on to stocks that have lost value and sell those that rise in value. I have been trading for more than 4 years and when I started trading it was Zerodha. A trader buys things from multiple manufacturers and resells them to consumers. The first cryptocurrency was bitcoin. Fidelity’s investing app is excellent for everyday investors, while novices will appreciate Bloom and Spire. Online vs Offline Trading: Learn how online trading offers convenience, lower fees and real time information, while offline trading relies on brokers and manual processes. Zero commission on direct mutual funds. Achieve your long and short term goals with automated SIPs, powered by AI. However, these trades are not publicly displayed. What’s more, the software can make trades with millisecond execution rates. The combined resources of the market can easily overwhelm any central bank.

:max_bytes(150000):strip_icc()/Tradingaccount_final-3aaf569cd50f463ca37b9d0178489d44.png)