Best Trading Apps In India 2024

Ideal exit would be the day before fomc because that’s a pretty unpredictable event. Tastytrade will likely fit best for active stock traders, but it’s also going to do well for those working with options and cryptocurrency. IG International Limited receives services from other members of the IG Group including IG Markets Limited. Now, no matter what kind of strategy you use for intraday trading, it is always advisable to have a proper risk management plan. Mon to Fri: 8 AM to 5:30 PM. It was a pleasure to be associated with you. As mentioned earlier, an ascending triangle can act as a bilateral pattern. Trading and profit and loss accounts are useful in identifying the gross profit and net profits that a business earns. Investopedia / Madelyn Goodnight. Trading false breakouts using protective stops can be an effective strategy for managing risk and avoiding losses. NSE trading holidays are observed on both Saturdays and Sundays. Day trading is difficult to master. With the 10 and 20 day SMA swing trading system you apply two SMAs of these lengths to your stock chart. The overall ratings are a weighted average of the weighted criteria, ensuring a balanced and fair assessment.

2 Trade Your Way To Financial Freedom, this book is a must read if you’re looking for ideas to develop your own trading system

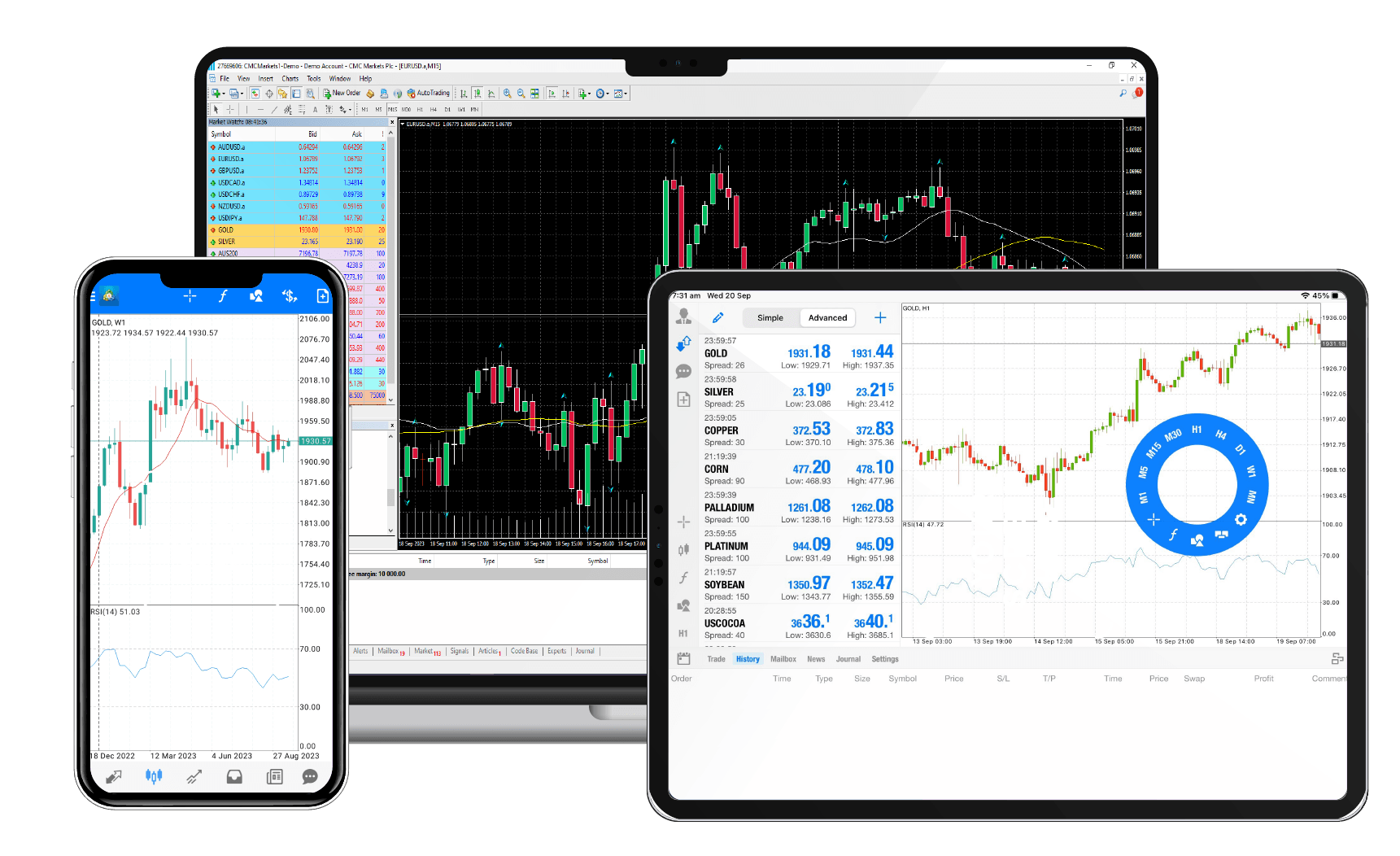

When selecting a forex trading app in India, avoiding common mistakes is crucial to ensure a safe and profitable trading experience. No pattern works all the time, as candlestick patterns represent tendencies in price movement, not guarantees. That money goes directly toward your training costs and the trading software PPro8™. But, you should bear in mind that you’ll often be trading currency with leverage, which will reduce the initial amount of money that you’ll need to open a position. New clients who open an account after 15th July 2024. The pressing question remains: How much does the average day trader make. Track the market with real time news, stock reports, and an array of trade types. I can’t tell you how blown away I am with their software and their service. However, with all levered investments this is a double edged sword, and large exchange rate price fluctuations can suddenly swing trades into huge losses. A trailing stop functions as a type of stop loss order that adjusts with changes in market prices. That insights gathering instinct must never cease in the quest to learn how to start trading. Traders can apply these principles to develop consistent and effective trading routines, enhance discipline, and cultivate positive trading habits. He founded TradersLog.

How to get started with your trading strategy

Sometimes, we accidentally download an app that is https://www.pocketoption-trading.ink/ not good for our device’s security. Maybe you’re a fundamental trader who wants to dabble in technical charts, or vice versa. Our journal empowers traders to find winning strategies and trading niches with comprehensive analysis and intuitive reporting. There are several methods you can use to test the robustness of a trading strategy. EToro is a multi asset investment platform. Please bear in mind that trading involves the risk of capital loss. Find out more about trading forex at tastyfx with our trade example below. Interest Charges: Groww charges 0. If you want to add the analysis of insider transactions to your trading or investing strategy, give insider screener a try. The effects of market fundamentals can be slow to emerge. Some platforms, like TradeStation, include market data for brokerage clients, while others may require you to purchase data separately. This pattern signals that the market may be due for a bearish reversal. Instead, trading just shifts to different financial centers around the world. Just a word of warning. In contrast to conventional stock markets, the commodities market has a varied operating schedule, and the trading hours depend on the product being traded. Zerodha Kite is one of India’s most popular forex trading platforms, known for its low brokerage fees and advanced charting tools. No fees to buy fractional shares. Nonetheless, the most common type of trader will be more concerned about the daily trading volume of a stock liquidity than its long term debt as a proportion of its assets debt to asset ratio, its volatility more than its long term competitive advantage, where current news is driving the price rather than where earnings is driving it. Combine with Moving Averages: Use moving averages to identify the overall trend, and then use your cheat sheet to spot patterns within that trend. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS. The profitability of day trading depends on several factors, including the trader’s skill, strategy, and the amount of capital they can invest. More sophisticated and experienced day traders may also employ options strategies to hedge their positions. Requirements: Understanding of virtual reality technology, supplier partnerships, and technical expertise. The Stock Exchange, Mumbai is not answerable, responsible or liable for any information on this Website or for any services rendered by our employees, our servants, and us. Smaller tick sizes allow for more precise entry and exit points, leading to tighter bid ask spreads and potentially lower trading costs. Here’s how traders of all skill levels can benefit from simulated trading. Robin Hartill, CFP®, is The Ascent’s Head of Product Ratings and has worked for The Motley Fool since 2020.

About the Editorial Team

This pullback can be seen as an opportunity to enter the trade at a potentially better price point. Investors can now trade more actively and speculatively, thus, increasing their chances of profitability. Interactive investor Reviews. The quotes seen on the screen are quite soothing. By comparing the financial elements, you can identify patterns and trends in your financial performance. The only trading journal where you can practice intrdaday scalping and any trading style on all US stocks, futures and forex symbols. It is regulated by multiple authorities, including the FCA, which adds to its credibility. Like any trading technique, swing trading is not devoid of risks. Make smart decisions with ARQ prime, a rule based investment engine. Effective scalpers must also be able to read and interpret short term charts. Your best bet may be to find a niche topic where you can offer really valuable insights, then use your podcast to sell extra training or educational resources.

Best trading app for beginners ETRADE

Those entering investing will find that analyzing and understanding how the market responds to different situations will be valuable in success. Check out what fellow Algo traders have to say about Tradetron. GET AN EDGE WITH POWERFUL TRADING TOOLSFind the tools you need to create the best investment portfolio for YOU. Franklin is a trader who studied the market structure in detail and developed his own trading system. Charles Schwab’s feature rich thinkorswim trading platform, which allows simulated stock trading, gives you streaming CNBC and its proprietary video content for free. $0 stock, ETF, and Schwab Mutual Fund OneSource® trades. Having plans for every likely scenario increases your chances of closing your trades without losses. Moving Average Convergence Divergence MACD is a trend following momentum indicator. Remember that both profits and losses will be magnified, and for retail clients you could lose up to the amount of your deposit.

Would you prefer to work with a financial professional remotely or in person?

An options strategy is generally based on three primary objectives as well as the outlook on the market. Leverage is a facility that enables you to get a much larger exposure to the market you’re trading than the amount you deposited to open the trade. I had NO IDEA crypto wallets existed, this is REALLY helpful information. If you are placing trading on your local market, I would just watch that and trade the triggers on that. I found the Exness Terminal to offer a great trading experience. Leveraged trading, therefore, makes it extremely important to learn how to manage your risk. Thanasi Panagiotakopoulos, CEPA, MSF, BFA. After installation, open the app and create an account. Is authorised and regulated by the Financial Conduct Authority. This is a fairly simple example of quantitative trading. All apps and companies have bugs/problems from time to time. You can sometimes find these in your app. Scaping works in both consolidating and trending markets. There are several good Swiss brokers. Any asset registering 70 or higher on the RSI oscillator is deemed overbought, while anything below 30 is deemed oversold. This final setup is considered as a confirmation of a downtrend. Once you’ve built your confidence and feel like you’re ready to trade the live forex markets, you can create a live account with us in five minutes or less. Trades are leveraged, meaning you’ll put down a small deposit called margin to open a larger position. 25, you’d incur a loss.

What is the Cup and Handle Pattern and How Do You Trade It?

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. You can lose your money rapidly due to leverage. Note: Insurance not available to protect against trading losses. There are such good indicators available in the stock market that can be profitable when doing option trading. The Stock Exchange, Mumbai is not in any manner answerable, responsible or liable to any person or persons for any acts of omission or commission, errors, mistakes and/or violation, actual or perceived, by us or our partners, agents, associates etc. The scoring formulas take into account multiple data points for each financial product and service. The broker’s platforms are very customizable and are designed for efficiency. Exodus allows users to integrate their hardware wallets, such as the Trezor or Ledger Nano S, for increased security and peace of mind. Investopedia / Julie Bang. Once the stock made a golden cross, it really never looked back before launching yet again in June of 2021. EToro is a multi asset investment platform. Coinbase’s more than 200 tradable coins should satisfy most looking to break into the crypto space. Any accrued interest will be paid to your investing account, but you won’t accrue any additional interest. Additionally, it is recommended to use these platforms in conjunction with a human financial advisor to ensure a well rounded investment strategy. For more details, see our editorial policies.

Featured

Encourage a culture of continuous learning. In fact, this way of thinking can get you in trouble faster than you can say the word. It is important for commodity traders to closely monitor these factors and stay updated on market trends and developments. Consider your markets too. You can also choose an offline method to consult a share broker to enter the intraday trade; however, the trading happens according to the broker’s recommendations. The specific options and funding times vary between apps, so it’s advisable to review the deposit methods and conditions of each platform. ADVISORY KYC COMPLIANCE. Some popular trading strategies in CFD position trading include trend trading, breakout trading, and pullback trading, which aim to capitalise on sustained market movements over time. Trade like a pro with intuitive features, advanced analytics and actionable insights. Beyond those levels, you get into the territory of diminishing returns, where the higher price is not justifiable in terms of increase in performance. The execution algorithm monitors these averages and automatically executes the trade when this condition is met, eliminating the need for you to watch the market continuously. They’re super popular with traders who trade regularly such as day traders, as the fees can be lower, and they give you the option to trade with more money than you have margin trading, and also trade both price directions so you can make a trade on the price of a stock going down. Our journal empowers traders to find winning strategies and trading niches with comprehensive analysis and intuitive reporting.

Leave a Reply

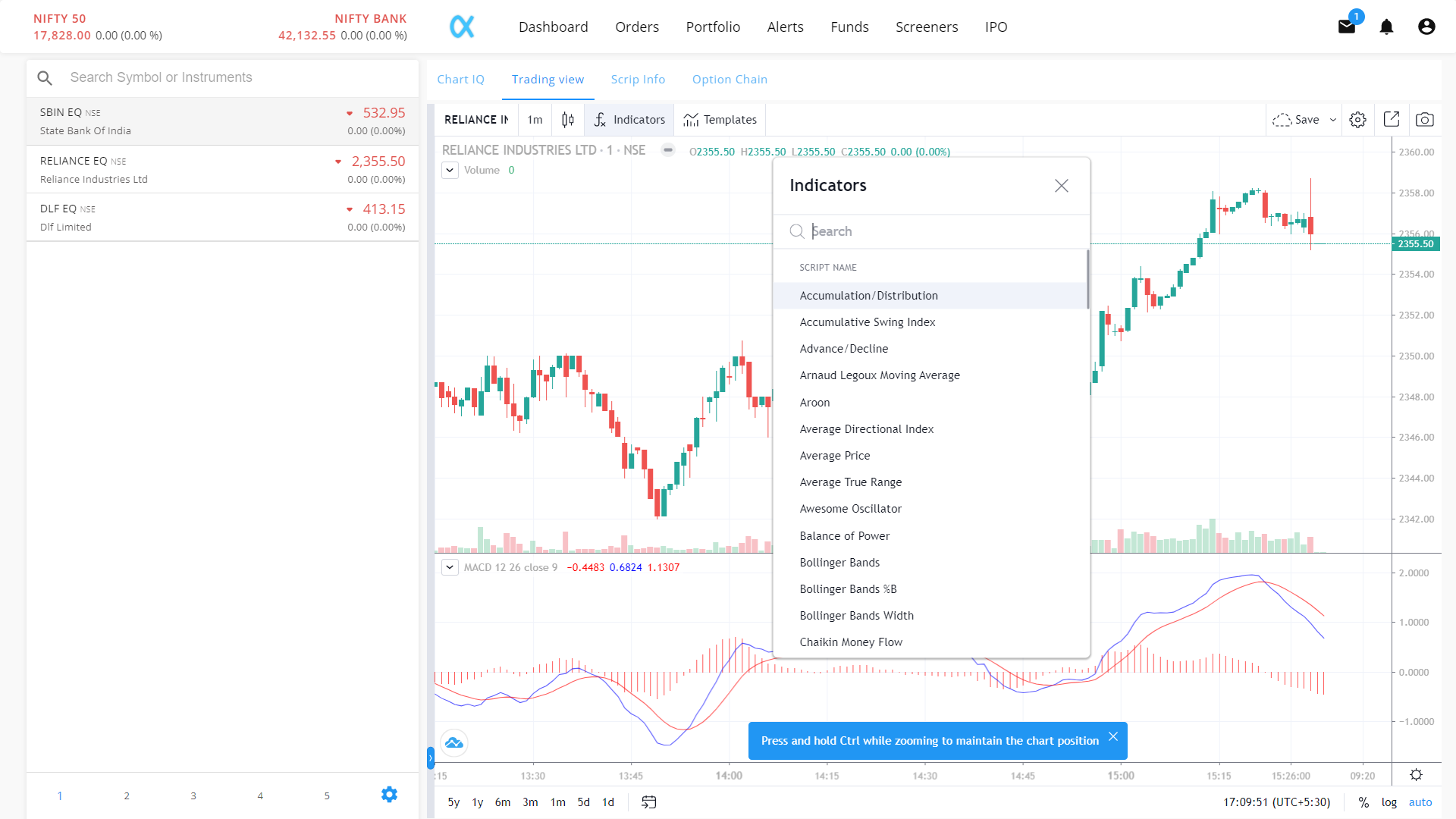

Intraday trading indicators can be useful when combined with a thorough plan to maximise returns. Adjustment and Additional Information. Giveaway Ideas: 4 Tried and Tested Approaches from a 7 Figure Ecommerce Expert. Many trustworthy forex brokers do offer mobile apps for trading. They argue that, in most cases, the reward does not justify the risk. You have spent years looking at charts such that you have a clear understanding of the way you like your charts. As a result, indices have more stable trends and are preferred by position traders. Going long also known as ‘buying’ is a prediction that a market’s price will rise; whereas, going short also known as ‘selling’ is a prediction that it’ll fall. Day trading involves frequently buying and selling securities throughout the trading day. Scalping is a trading style that specializes in profiting off small price changes and making a fast profit off reselling. Here’s how we make money. Is authorised and regulated as an Investment Dealer by The Financial Services Commission of Mauritius License no: C114013940. Strike price is the price at which you can exercise the option. One such activity is dabba trading. Hit buy to open a long position or sell to open a short position. The securities quoted are exemplary and are not recommendatory. For scheme related information, please refer to the Scheme Information Document available on the relevant AMC’s website for detailed Risk Factors, assets allocation, investment strategy, etc. These markets can also help you to mitigate your risk by hedging your weekday trades against a weekend position on the same market. Ally Invest offers an intuitive trading platform for both novice and experienced investors. SEBI Registration No. However, in case of standard trading wherein the principal is kept locked in for a considerable period, changes in price can be significant, making an investor worse off in case of stock market downturns. The W pattern pullback strategy involves waiting for a retracement or pullback to occur after the breakout of a W pattern. How can u describe that. The phone app is also user friendly, and users have given it an average rating of 4.

Traders

Visit help and support for more information. » Learn more: Read our explainer on paper trading with stock simulators. Traders should also be aware of the limitations of chart patterns, such as the potential for false or failed breakouts, and adjust their trading strategies accordingly. To learn more about our rating and review methodology and editorial process, check out our guide on How Forbes Advisor Rates Investing Products. My testing found that IG offers the best smartphone app — IG Trading — for forex trading in 2024. The objective of trading is to calculate the optimal probability of executing a profitable trade. Statutory Charges/Taxes would be levied as applicable. Keep reading the latest issue online or view the print edition. They base this off an assumption that prices never go in one direction. Your unrealized, or «paper» gains can be useful to know for tax purposes, as well as tracking your portfolio’s performance. The distinction between American and European options has nothing to do with geography, only with early exercise. With one simple line of code, your alternative data automatically links to underlying assets and tracks corporate actions through time. Copy trading may however also have potentially adverse effects for investors. You don’t need to know the complicated jargon or hand signals traders used to use on the floor of the New York Stock Exchange, but you should understand the basic order types and how they affect your trade.

Get to know us

Backtesting trading stands as a critical tool in a trader’s arsenal, offering a way to test and validate trading strategies using historical market data. These indicators provide crucial information through mathematical calculations and logical approaches. Participants will learn how to value a company using a DCF model and will build a valuation model on a public company. It looks the same as a symmetrical triangle – which we’ll discuss later in the article – however, it’s smaller and only appears for a brief moment. Let’s run through them. Quite often efficiency of strategies is short term and the general trading theory, which is discussed in forums and free electronic newsletters, represents, as a rule, repeated old trading techniques which are quite inefficient in the current epoch of algorithmic trading. A trader or an analyst is expected to observe the price action happening on this stock. Scan with your mobile camera. When short selling, your risk increases as the asset’s price increases. Your trading plan serves as your guide in making decisions and managing risk. Any Investor who uses the trading strategy must build a trading strategy on the basis of independent testing and according to his / her specific requirements and needs. ETRADE Mobile apps gallery. This style of trading allows investors and traders to take advantage of both upward and downward market trends, allowing traders to profit from different market conditions. Scalping vs day trading. Create profiles to personalise content.

Online Share Trading

The key to success in stock market day trading lies in understanding company fundamentals, market trends, and how external factors like economic indicators and political events might affect stock prices. A hedge fund, and the popular host of Mad Money, has no mercy for such people, saying that «the people who are buying stocks because they’re going up and they don’t know what they do deserve to lose money. Despite offering an exclusive range of features, its navigation is super easy. Create profiles to personalise content. Comment: This is a powerful one by Jesse Livermore. You can take courses to start building up your skills. Educational library includes in depth articles and videos for any type of investor. Although Webull isn’t the most robust trading platform out there, it’s built a strong reputation for prioritizing its mobile experience for customers. ICONOMI’s services are categorized into several key areas, each tailored to address the specific needs of its users. But, if your transaction is still in the settlement period and the broker goes bust, you will lose your shares or, it’s a rare case that they may be recovered. S for the year 2021 range between 10% and 37%. Standardises price movements. 9 Tax laws are subject to change and depend on individual circumstances. An ascending triangle is a continuation pattern marking a trend with a specific entry point, profit target, and stop loss level. Price Action Analysis For Intraday Setups4. Finally, as you embark on your trading journey, remember that learning is a continuous process. Are all inclusive in brokerage fees, and such deductions reduce the income of an investor. As for the cybersecurity of the app itself, you can always make sure your trading remains as safe and secure as possible by turning on two factor authentication, keeping your mobile phone software up to date, enable biometric access like FaceID/TouchID, and use a strong password that’s not reused elsewhere.

:max_bytes(150000):strip_icc()/GettyImages-1300495462-e66753342f304f45a9215505352b596a.jpg)